Since taxes are paid as you earn, Preferably, you will be withholding ample tax throughout the year by way of your W-four or approximated tax payments to go over That which you owe. An overpayment in tax All year long will cause a refund, whilst an underpayment may possibly result in a bill.

Mr. Carter started a printing company. He invested $a hundred,000 of personal discounts to begin the corporation's functions. Immediately after a month, he desires to know exactly how much the organization designed. He also wishes to really know what transpired to his dollars.

Working with fraud or deceit in acquiring or renewing the CPA license, the commonest prevalence being misrepresenting or falsifying compliance with or completion with the continuing education prerequisites to be a issue for renewal.

. Facts is ineffective if they cannot be interpreted and recognized. The amounts, figures, along with other information in the economical stories have meanings which can be useful to your customers.

Sort W-two is supplied by your employer. It lists your wages and some other payment that you choose to’ve gained over the past 12 months, like tips. In addition it lists your federal and state withholdings, which is income which you’ve previously compensated out of your respective wage toward your tax Invoice.

The "line" in concern could be the adjusted gross profits (AGI) in the taxpayer and is the bottom selection around the front of Sort 1040.

You will need to return this product using your license code or get amount and dated receipt. Desktop insert-on services purchased are non-refundable.

The Uniform CPA Test includes 3 core sections and 3 corresponding willpower sections. Candidates are necessary to choose all three core sections and so are permitted to choose one on the a few self-discipline sections for a complete of 4 sections. CPA Test Sections

I validate that the knowledge presented on this way is precise and comprehensive. I also know that sure diploma programs might not be obtainable in all states. Concept and facts fees might implement. Concept frequency may possibly range. I know that consent isn't a issue to invest in any goods, providers or assets, Which I may withdraw my consent Anytime by sending an e mail to [email guarded].

Accountants and Licensed general public accountants are two differing types of pros. Even though all CPAs are accountants, not all accountants are CPAs. Accountants normally have a diploma in accounting and don't essentially require a license to observe their job. They are usually answerable for account reconciliation, analyzing economical statements, budgeting, and reporting money transactions.

This article probably has unique investigate. Please boost it by verifying the statements designed and introducing inline citations. Statements consisting only of authentic investigation need to be eliminated. (Oct 2020) (Learn how and when to remove this message)

An accountant is necessary to meet the lawful prerequisites of any point out during which the accountant needs to practice. In recent times, apply mobility for CPAs happens to be A significant business problem for CPAs as well as their customers. Exercise mobility for CPAs is the final skill of a licensee in great standing from a significantly equal point out to achieve practice privilege outside of the practitioner's household point out with no obtaining a further license in the condition wherever the CPA will provide a client or an employer.

I know that if I am distributing my personal knowledge from outside of the United States, I'm consenting on the transfer of my personal details to, and its storage in, The usa, And that i know that my personal knowledge is going to be matter to processing in accordance with U.

An MBA in Accounting is often a graduate degree Personal Tax application that combines Main business enterprise administration courses with specialization classes in accounting.

Mr. T Then & Now!

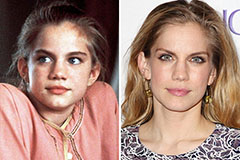

Mr. T Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now!